Have seen this update from Finance Manila regarding the ongoing switch from the Maktrade system to the NTS.

Effective Monday 26 July 2010, the Philippine Stock Exchange will be implementing the new trading system with a new set of trading rules, as part of their commitment to enhance the trading experience and support systems for all investors, trading participants and PSE support groups.

In line with making such changes, COL will need to bring down the website from 3PM on July 23 (Friday) until July 25 (Sunday) to make the necessary changes and run testing with the PSE. All pending ATO and GTC orders will be flushed clean and will have to be re-posted by you on Monday morning July 26 at 9AM+.

Below are important changes to the Trading Rules that immediately affect your trading activities with CitisecOnline under the new PSE system:

1. New Trading Schedule

There will now be a Pre-Close period prior to the Run-off Period of 12noon.

8:45 am - National Anthem

9:00 am - Pre-Open*

9:30 am - Market Open

11:57 am - Pre-Close *(NEW)

12:00 pm - Run-off / Trading at Last

12:10 pm - Market Close

* You can modify and/or cancel your orders during the Pre-Open period between 9:00am to 9:15am and the Pre-Close period of 11:57am to 11:58am. During the periods of 9:15 am to 9:30 am and during 11:58 am-12:00 pm, modifications and/or cancellations of orders will be allowed by the system.

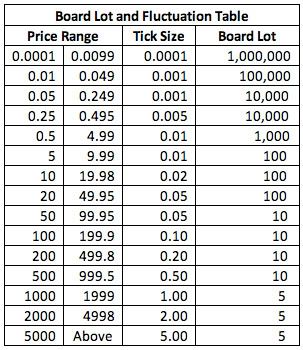

2. New Board Lot and Price Fluctuation Table

The new board lot and price fluctuation table for all stocks listed in the PSE are as follows:

3. Implementation of Trading Price Limits

The price of an order shall be within the Trading Limits for the Trading day. There are two limits implemented; i.e., Static and Dynamic Thresholds.

The Static Threshold used to be known as the Floor and Ceiling Prices and is computed as follows:

- The upper Static Threshold shall be fifty percent (50%) above the Reference price (closing price)

- The lower Static Threshold shall be fifty percent (50%) below the Reference price (closing price)

The Dynamic Price Threshold** is computed as follows:

- Dynamic price threshold (upper) = last traded price + (last traded price multiplied by the dynamic tick)

- Dynamic price threshold (lower) = last traded price - (last traded price multiplied by the dynamic tick)

** An order entered breaching above or below the Dynamic Threshold will cause the security to be Frozen by the PSE stopping all trades until the PSE reactivates the security with a new Dynamic Threshold.

Example:

If the last traded price for stock A is 5.00 pesos and it has a PSE defined dynamic tick of 0.05 then:

- Stock A dynamic price threshold (upper) = 5.00 + (5.00 x 0.05) = 5.25

- Stock A dynamic price threshold (lower) = 5.00 - (5.00 x 0.05) = 4.75

4. Closing Prices will now be calculated during the Pre-Close Period which will be similar to pre-opening calculations of the opening price.

A Pre-close period (from 11:57-12:00) will be added similar to pre-open that will freeze matching for three minutes but allowing posting. Cancellations and modifications to orders are only allowed from 11:57-11:58 thereafter only posting of new orders are allowed until 12:00. Noon time will bring about a closing price that will match pre-close posted orders then continue trading at the closing price until 12:10.

5. Partial matching of Odd-lot orders will now be allowed.

6. Good-Till-Cancelled orders will now cover a period of seven (7) calendar days instead of seven (7) trading days.

All present GTC orders will be cancelled by end of day Friday July 23, 2010 to make way for the new data format on Monday. Placement of GTC orders will resume on July 26 Monday 9:00 AM. GTC orders may be entered during ATO (after trade hours). But GTC orders that have already been sent to the Exchange can only be cancelled or changed during allowable moments in pre-open (9:00-9:15) and during trading time. You can still send an advanced notice to cancel or change the GTC order during ATO periods but its effect on earmarked balances and positions will only take effect at 9:00 AM onwards.

7. Please note that all other current order types in the COL system (Limit order, Day order, At-The-Open, and At-The-Close) will remain the same under the COL system. There will be no added order types in the initial phase of the new system implementation. The PSE will in time introduce new order types to which we will inform you of its implementation. *Other brokerages’ online trading system may vary!

Will update you more regarding this new system. I just check my COL account and seems that there were glitches encountered today. I was placing an off-hours order yesterday but the usual off-hour page says "off-hour order closed". I hope COL can fix the problems and will be soon able to place orders during off hours.

No comments:

Post a Comment